The U.S. Department of Agriculture February dairy supply and utilization report provided a look behind the markets.

Speaking in the April 22 “Dairy Radio Now” broadcast, HighGround Dairy economist Betty Berning said butter jumped out from it.

“We knew butter exports were down in February,” she said. “We heard reports of robust demand stateside as part of the narrative as to why butter prices were pushing $3 per pound. But, when looking at this report, we learned that domestic usage and exports were down.”

Butter usage totaled 161.2 million pounds, down 6.3%, as domestic usage fell 4.9%. No surprise that exports were down 35.2%. HGD said February inventories were healthy as well, indicating that neither high demand nor lack of supply were behind the elevated price.

Cheese consumption totaled 1.15 billion pounds, down 1.5% from February 2023, with domestic consumption down 3.5%. American style was down 7.3%.

Cheese exports totaled 95.5 million pounds, up 27.2%, led by the other-cheese variety, up 27.6%, and a new all-time high, according to HGD.

“Low prices on the CME spot market, which have been heavily discounted to Europe since November 2023, likely helped spur additional sales,” HGD said.

Nonfat dry milk utilization, at 182.3 million pounds, was up 2.4% but only because February 2023 was the weakest for the month since 2019, according to HGD. Berning said domestic consumption was down almost 3%, so exports carried the day despite reports of struggling international demand. She said it remains to be seen if those exports remain strong.

Dry whey utilization, at 66.8 million pounds, was down 3.2%. Exports were down 5.6%. HGD said dry whey exports have been down since March 2023, with the exception of this January. Domestic demand wasn’t great either, Berning said.

The USDA announced the May federal order Class I base milk price at $18.46 per hundredweight, down 72 cents from April and $1.11 below May 2023. It equates to $1.59 per gallon, down from $1.68 a year ago. The five-month average is at $18.58, down from $20.12 a year ago and $22.81 in 2022.

The USDA’s latest livestock, dairy and poultry outlook reported, “Consumer price indexes for selected dairy products were year-over-year lower in March, while the indexes for overall prices and food prices show that the inflationary pressures are lingering. Of note, the CPI for all dairy products has been year-over-year lower since September of last year.”

The latest “Margin Watch” from Chicago-based Commodity & Ingredient Hedging LLC reported, “Dairy margins were mixed over the first half of April, strengthening slightly in nearby periods following a price recovery in cheese and the Class 3 milk market while deferred periods held steady.

“The feed market was relatively flat with USDA releasing the April World Agricultural Supply and Demand Estimates report, which did not cut corn ending stocks as much as expected despite increased projected usage. The cheese market caught a bid with block and barrel prices rallying to the highest level in six weeks at $1.61 per pound, and lower prices in the first quarter may have renewed export interest.”

U.S. cheese remains the least expensive in the world, according to the MW.

“Mexico has been a bright spot for U.S. export demand,” the MW said. “February dairy product exports totaled 501.1 million pounds, up 5.5% from 2023 after adjusting for leap day and the first time that February shipments have exceeded 500 million pounds, with cheese exports of 95.6 million pounds up 27.3% from last year including 36.6 million pounds to Mexico. Domestic demand has been more lackluster, as January demand was down 2.8% from 2023 while demand in February slumped by more than 4% after adjusting for leap year. U.S. demand for American-style cheese has been particularly weak, down nearly 6% in January and February compared to the first two months of 2023. Butter demand by contrast has been robust, with the market hitting an all-time high for April at $2.97 per pound despite ample stocks and rising production from increased milkfat content, as buyers fear tighter supplies later in the year.”

The 40-pound cheddar blocks closed the third Friday of April at $1.68 per pound, up 14.50 cents on the week, fourth consecutive week of gain and the highest CME price since Nov. 7, 2023, but 7 cents below a year ago, as traders anticipated Monday’s March milk production report.

The 500-pound cheddar barrels finished Friday at $1.66, 8.75 cents higher, 10.75 cents above a year ago and 2 cents below the blocks. CME sales amounted to 23 loads of each on the week.

Dairy Market News reports the spring flush is here as milk levels near their peak in parts of the western U.S. and trend seasonally higher in the East and Midwest.

“As cheese market tones show further signals of life, the same is being said among contacts regarding demand,” DMN said. “Customers are trying to get ahead of increasing market price points.”

Cheese supplies are available in the Midwest but are not at levels of concern. Spot milk availability shifted lower, and mid-week prices ranged $3- to $1-under Class III. A year ago, they were $11- to $4-under Class, according to DMN.

Manufacturers note strong cheese production in the West as plenty of milk is seasonally available. Cheese stocks are also readily available. Demand is steady to moderate, and international buying is steady to stronger, particularly from southern neighbor purchasers. Sources indicate immediate- to short-term sales continue to be more prevalent than sales for deliveries past second quarter. Some processors report that production is outpacing demand, DMN said.

CheeseExpo was held in Milwaukee, Wisconsin, and StoneX said that the takeaway from expo is that something around $1.60 per pound cheese is a good market clearing price today. Demand for fresh cheese is reportedly improved; however, “sustainability of demand is the key to holding prices up.”

“Further price strength for spot cheese will begin to usher in a change in the 2024 trend of modest pops in price that don’t last,” StoneX said.

CME butter climbed to $2.94 per pound Tuesday but backed off to close Friday at $2.92, unchanged on the week but 52 cents above a year ago, on eight sales.

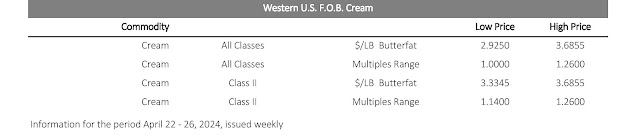

Midwest butter makers report summer and fall inventories are in fair shape. Churning has been robust with plentiful cream. For the second consecutive week, spot cream multiples were below 1.00. Butter demand is steady. Interest remains for both unsalted and salted, but a number of customers say unsalted 82% butterfat availability (for export) is difficult to locate.

Western butter makers note strong to steady production as they work to build unsalted and salted butter inventories. Some processors convey unsalted butter availability is tight. Cream multiples were at or near those of last week. Cream remains readily available throughout most of the region. Domestic butter demand is mixed with some notes of lighter interest for retail and bulk butter. Export demand is steady to moderate, according to DMN.

Grade A nonfat dry milk closed at $1.12 per pound Friday, down 2.25 cents on the week and 4.50 cents below a year ago. There were 16 sales on the week.

A weaker than expected Global Dairy Trade this week may have provided the spot weakness.

Dry whey closed Friday at 39.25 cents per pound, up 3.25 cents on the week, highest in three weeks, and 3 cents above a year ago, on 28 sales.

Updating the avian or bovine influenza outbreak, StoneX economists Nate Donnay and Dustin Winston said, “The detection of avian influenza in the U.S. dairy herd has helped to firm market sentiment but hasn’t had a big impact on prices. As of April 16, the USDA confirmed infections on 26 farms, but we think the true number is closer to 100.

“Now that the mystery disease has been identified, and there isn’t any treatment for it, some farmers are choosing to handle it quietly. That means the confirmed number of cases from the USDA probably won’t be a good indicator for how widespread the problem is, and the impact will show up in prices first and then eventually in the milk production data.”

They do not see a big impact on milk production and said only 10%-15% of the cows infected show significant symptoms and most recover in about two weeks.

“Total production for the farm is down 15%-25% for a couple of weeks, which works out to about a 1% reduction for the course of a year,” they said. “With about 26,500 dairy farms in the U.S., we would need almost 3,000 farms infected to knock 0.1% off of annual production. That is certainly possible, but if it is spread out over a few months, even the short-term impact would be minimal.”

Dairy cow slaughter for the week ending April 6 totaled 57,400 head, up 700 from the previous week, but 4,300, or 7%, below a year ago. Year-to-date, 805,200 head have been culled, down 128,000, or 13.7%, from a year ago.

This was the closest to year-ago levels that it has been all year, according to StoneX.

“Total beef slaughter exceeded year-ago levels for the first time this year, rising 1.57% above 2023 levels,” StoneX said. “This increase led to a tightening in the market share that dairy cows are holding in the beef market this week.”

The USDA’s latest crop progress report shows 6% of the U.S. corn crop had been planted, as of the week ending April 14, 1% behind a year ago but 1% ahead of the five-year average. 3% of the soybeans are in the ground, dead even with a year ago and 2% ahead of the five-year average.

The GDT weighted average inched up 0.1% Tuesday, following a 2.8% jump April 2.Traders brought 38.9 million pounds of product to market, down from 41.3 million April 2 and the lowest since Dec. 15, 2020. The average metric ton price inched to $3,590, from $3,558 April 2.

Anhydrous milkfat led the gains, up 1.7%, after gaining 2.3% April 2; however, butter was down 1.4% following a 3.1% rise. Whole milk powder was the only other product showing a gain, up just 0.4% after a 3.4% rise. Skim milk powder was unchanged following a 1.4% rise April 2.

Cheddar led the declines after leading the gains April 2 and dropped 8.5% following a 4.1% rise. Mozzarella was down 3.8%. Lactose was down 1.3% following a 3.1% drop April 2.

StoneX said the GDT 80% butterfat butter price equates to $2.8968 per pound, down 2 cents from April 2, and compares to CME butter which closed Friday at $2.92. GDT cheddar, at $1.8023, was down 16.6 cents, and compares to Friday’s CME block cheddar at a real bargain $1.68. GDT skim milk powder averaged $1.1524 per pound, down from $1.1568. Whole milk powder averaged $1.4830 per pound, up from $1.4726. CME Grade A nonfat dry milk closed Friday at $1.12 per pound.

North Asia purchases, which includes China, were weaker than both the previous GDT event and year-ago levels, said analyst Dustin Winston. Southeast Asia purchases increased from both the last event and last year’s levels. Increases in SMP purchases by Southeast Asia was a large part of the support in total purchase volume. Africa purchases were also stronger than the last event by more than double and outpaced last year by more than triple, Winston said.

Cooperatives Working Together member cooperatives accepted six offers of export assistance this week that helped capture sales contracts for 1.2 million pounds of American-type cheese and 176,000 pounds of whole milk powder. The product is going to customers in Asia, Central America, the Caribbean and Middle East-North Africa through June.

CWT-assisted exports now total 32 million pounds of American-type cheeses, 309,000 pounds of butter, 617,000 pounds of anhydrous milkfat, 8.1 million pounds of whole milk powder and 3.1 million pounds of cream cheese. The products are going to 25 countries and are the equivalent of 402.4 million pounds of milk on a milkfat basis.

Meanwhile, the U.S. Dairy Export Council, National Milk Producers Federation and Consortium for Common Food Names commended the House Committee on Ways and Means’ markup of a bill this week that would renew the Generalized System of Preferences trade program with new agriculture-specific eligibility criteria, giving U.S. dairy producers a fairer opportunity to sell products in key markets. GSP has not been in effect since it expired at the end of 2020.

The GSP trade program helps developing countries use trade to grow their economies by eliminating U.S. duties for a wide range of products. GSP-eligible countries must meet certain conditions. The bill will introduce provisions for the agriculture industry, including requirements that beneficiary countries provide open and equitable market access to U.S. agriculture exports and protect the generic use of common food and beverage terms like Parmesan and feta.

“The U.S. dairy community is grateful for these expanded criteria, which will enable America’s dairy farmers and producers to compete on a level playing field in these new and growing markets,” said Krysta Harden, USDEC president and CEO. “A special thank you to Reps. Adrian Smith, Jimmy Panetta and Michelle Fischbach, who continue to be champions for the U.S. dairy industry. Now more than ever, our members count on exports to succeed, and we look forward to supporting this bill through to the finish line.”