Week-over-week differences in milk production continue to be positive for California. However, stakeholder notes concerning preliminary February 2025 year-over-year milk production are mixed. In a few cases, February 2025 year-over-year milk production gaps are indicated to be increasing further. However, in most cases, February 2025 year-over-year milk production gaps are indicated to be decreasing. In terms of herd sizes, a few industry participants convey their herd sizes haven't fully recovered. Demands for all Classes are steady.

For Arizona, farm level milk output is seasonally stronger. However, some stakeholders express uncertainty about what effects near-term herd health challenges will have on milk output for the state. Demands for all Classes are unchanged.

Milk production in New Mexico is seasonally strengthening in line with anticipated paces. All Class demands are steady.

For the Pacific Northwest, week-overweek milk production is generally increasing. However, a few handlers convey milk volumes are below anticipated amounts recently. That said, milk volumes are sufficiently accommodating needs of manufacturers. Class I, II, III, and IV demands are steady.

In the mountain states of Idaho, Utah, and Colorado farm level milk output is seasonally stronger. handlers note milk output to be in line with or above anticipated volumes. Idaho and Utah manufacturers describe milk volumes as in good balance with processing capacities, but also not difficult to find a buyer for if need be. All manufacturing Class demands are steady.

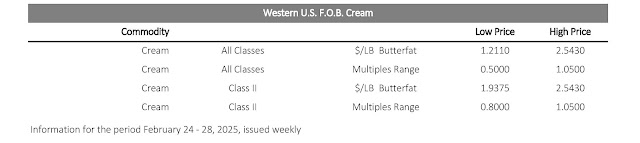

Cream volumes remain heavy in the region. Cream multiples moved lower this week. Distressed cream load offers were reported at cream multiples below the bottom-end of the All-Classes range for the West. Cream demand is mixed. Condensed skim milk availability and demand are steady.

.jpg)