The bleeding does not stop. The underlying cash prices provide no support to the market. Tariffs are going to be implemented on Mexico and Canada next week. The uncertainty of those tariffs leaves buyers of dairy products uncertain over demand. The current supply of milk is sufficient for bottling and manufacturing, with spot milk prices $2.50 below class-to-class. The USDA released the January Agricultural Prices report showing the average prices for most commodities. Some prices determine the income over feed price for the Dairy Margin Coverage program. The average corn price was $4.29, up $0.06 from December. This compares to $4.74 per bushel in January 2024. The premium/supreme hay price was $242.00 per ton, up $12.00 from December. This compares to $274.00 per ton a year ago. The All-milk price was $24.10, up $0.80 per cwt from December and up $4.00 from January 2024. The average soybean meal price will not be released until Monday, as that is not in this report. Some other prices of interest were the alfalfa price in January at $161.00 per ton, down $3.00 from December and down $41.00 per ton from a year ago. The soybean meal price was $10.00 per bushel compared to $9.79 in December and $12.80 in January 2024. The average price for milk cows was $2,660.00 compared to $1,890.00 a year ago.

AVERAGE CLASS III PRICES:| 3 Month: | $19.08 |

| 6 Month: | $18.61 |

| 9 Month: | $18.56 |

| 12 Month: | $18.49 |

For the week, blocks declined 12.50 cents, with 13 loads traded and a weekly average price of $1.8550. Barrels declined by 2 cents, with eight loads traded and a weekly average price of $1.7945. Dry whey declined 3.50 cents, with four loads traded and a weekly average price of 52.80 cents.

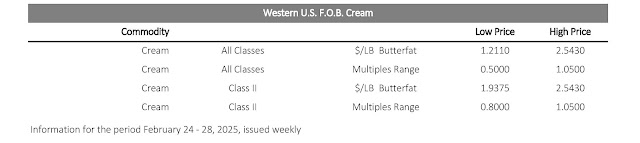

BUTTER:For the week, butter declined 7 cents, with 33 loads traded and a weekly average price of $2.3480. Grade A nonfat dry milk declined 4 cents with 19 loads traded and a weekly average price of $1.2065. Abundant cream supplies will leave the upside price potential limited. Buyers continue to increase ownership as the price declines, reducing the need to become aggressive later in the year.

OUTSIDE MARKETS SUMMARY:May corn closed down 11.50 cents per bushel at $4.6950, May soybeans closed down 11.50 cents at $10.2575 and May soybean meal closed steady at $300.20. May Chicago wheat closed down 6.75 cents at $5.5575. April live cattle closed down $3.48 at $192.65. April crude oil is down $0.59 per barrel at $69.76. The Dow Jones Industrial Average is up 601 points at 43,841 with the NASDAQ is up 303 points at 18,847.

.jpg)