MILK:

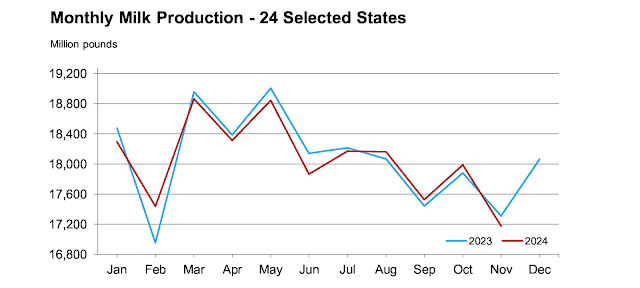

Most areas of the country report steady to higher milk output. Not compared to a year ago but compared to previous weeks. Milk production is running below a year ago leaving little concern over processing capacity. The holiday demand is behind, and schools will be reopening soon. This will increase bottling demand again. The USDA released the November Agricultural Prices report today. The average corn price was $4.07 per bushel, up $0.08 from October but down $0.56 from November 2023. The premium/supreme hay price averaged $235.00 per ton down $1.00 from October and down $36.00 per ton from a year ago. The All-milk price was $24.20 per cwt, down $1.00 from October, but up $2.60 from November 2023. The average soybean meal price has not been released. That is the missing price used to determine income over feed for the Dairy Margin Coverage program. Other prices of interest are the soybean price average of $9.84, down $0.07 per bushel from October and down $3.16 from a year ago, and the alfalfa hay price of $165.00 per ton, down $8.00 from October and down $44.00 from November 2023.

AVERAGE CLASS III PRICES:

| 3 Month: | $20.25 |

| 6 Month: | $19.76 |

| 9 Month: | $19.53 |

| 12 Month: | $19.34 |

CHEESE:

Cheese prices were steady to higher, but Class III futures closed under significant pressure. The selling was likely tied to traders liquidating ahead of the end of the year to close out their books. Spot milk prices have fared well over the holiday season with prices ranging from $0.50 -- $4.00 under class. That is unusual at this time of year as schools are closed and there is generally a lot of milk available on the spot market. If milk production continues along a similar pattern through the early part of 2025, we could see stronger milk prices.

BUTTER:

The butter price declined in the first two days of the week, but the downside is expected to be limited. The large decline in inventory in November reduced supply significantly and could result in the market following a similar pattern as last year. Full churning schedules will resume later this week with plentiful cream supplies available.

OUTSIDE MARKETS SUMMARY:

March corn closed up 6.25 cents per bushel at $4.5850, March soybeans closed up 18.75 cents at $10.1050 and March soybean meal closed up $5.10 per ton at $316.90. March Chicago wheat closed up 3.25 cents at $5.5150. February live cattle closed up $1.30 at $191.60. February crude oil is up $0.73 per barrel at $71.72. The Dow Jones Industrial Average is down 30 points at 42,544 with the NASDAQ down 176 points at 19,311.

.jpg)

.jpg)

.jpg)

.jpg)